Inside The Group Chat

How conversations with close friends grounded a life-changing pivot five years ago

Everyone has a group chat—or should. Mine began almost 10 years ago in Villa de Leyva, a quaint Colombian town four hours northeast of Bogotá. My wife and I joined college friends there for another friend’s wedding, a global reunion requiring a lot of logistical coordination for daily adventures and meetups. WhatsApp became our lifeline, linking people that were there from all over the world. That small core group of American college friends still chats daily. It’s honestly wild how it keeps us tethered. Our wives aren’t so thrilled! And it was this same group chat that first encouraged me to write on Twitter/X back in 2020.

These group chats are like digital lifelines. They keep us grounded, let us rant to those who “get us,” and offer an outlet in a chaotic world we ironically need that world to access. They’ve seemingly become so universal they’re now fodder for philosophical and anthological discourse.

When I moved to Amsterdam in 2023, sadly I lost a decade of group chat history with my best friends—my own fault for not archiving it amid the chaos of relocating. That loss stung, especially now, five years past “The Day That Changed Everything”—March 11, 2020—when COVID-19 flipped the world upside down. I wanted to revisit what I was thinking then, how those thoughts led me from suburban New Jersey, where I’d lived all my 30+ years (minus college), to a new life across the Atlantic. My friends, being the legends they are, dug up our old messages from that day. Reading them now, I see the dominoes that fell, taking me from a Wall Street analyst to self-employed family man in the Netherlands.

March 11, 2020 - “The Day That Changed Everything”

I was a year into my dream job at a top investment bank in NYC, coming from another bank where I’d spent four years. My wife was home with our 18-month-old son, our first. March 11, 2020, was chaos—when the WHO declared COVID-19 a global pandemic. The Dow cratered almost 1,500 points (~6%) to under 24,000. The S&P 500 fell 140 points (~5%) to under 2,800. The Nasdaq dropped 392 points (~5%) to under 8,000. Any stock tied to vacations, personal services, or going outside at all were plunging. Working on Wall Street, staring at Bloomberg terminals as headlines screamed panic, was pandemonium. Impossible to look away.

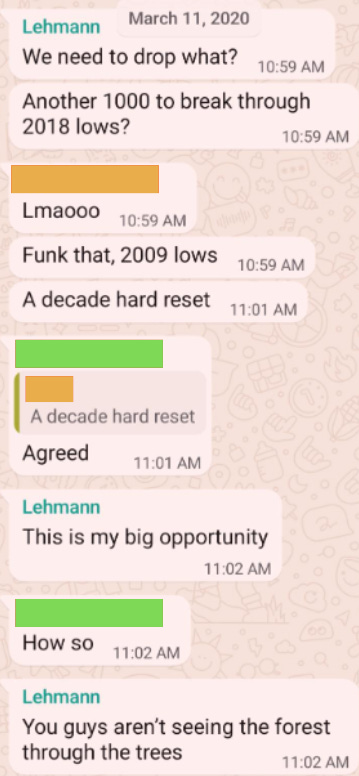

In our group chat, I typed: “This is my big opportunity.”

It sounds cold now, given the human toll, but it was early. Only about 4,000 people had died globally from COVID-19, with about 120,000 cases, mostly in China and Italy. My family and I would end up catching the virus later, but in March 2020, it felt distant. Still, its rapid spread and high mortality rate was enough to trigger lockdowns and a market collapse.

Amid this chaos, I was dumping our life savings into the market every day even as it kept getting worse and worse.

Why? I’d been here before. I’d paid attention.

March 9, 2009 - The Financial Crisis Low

Eleven years earlier, on March 9, 2009, I was a 21-year-old Penn State senior, flying to Jackson Hole for a spring break ski trip with college buds. My girlfriend (now wife) was studying in Italy, annoyed I didn’t visit her instead. She still hasn’t let me live that one down, 16 years later—a lesson for the young folks!

On that flight, CNBC was blaring sheer panic on United DirectTV. The Dow hit its financial crisis low, closing at 6,547, the lowest since April 1997. It was down 54% from its 2007 peak. Financial stocks were literally approaching zero and signaling a banking collapse. A depression seemed likely.

I felt a strange clash: pure excitement for the ski trip, graduating, and my awesome girlfriend, against a world falling apart—banks bailed out, friends’ internships canceled. Watching from that plane seat, I thought: Humans are panicking, predictably, but everything will be OK.

Problem was, I had no money. I was working as an EMT for my university’s ambulance service, earning $8-10 an hour, I had maybe a few grand to my name. Rent was $300 a month in an old converted frat house with 10 guys, but college debt loomed. I promised myself that if this ever happened again, and I actually have money, I’m going all-in.

Why? I saw (and continue to see) market crashes as binary — the classic “BTFD.”

Either people are overreacting, overshooting the downside, and the market snaps back if not immediately then soon enough.

Or the world truly collapses, and we’re all fighting for necessities, not stocks.

This “binary outcomes” mindset has become a core guiding belief.

The next day, I sent my girlfriend now wife a note. I was in good spirits and looking forward to the future, despite being at the literal deepest depth of the financial crisis.

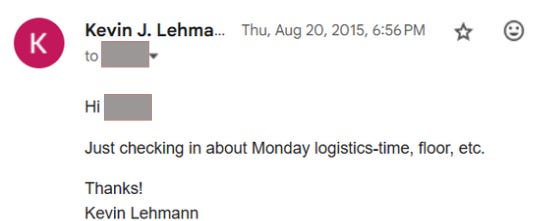

August 24, 2015 - The Flash Crash

Fast forward to August 24, 2015, my first day at my first firm in equity research, covering consumer stocks like Hershey and McDonalds. I was giddy and checking in with HR a few days before my start.

The road to this job was long. I quote-tweeted a post from High Yield Harry about it a few months back on X when he was helping gather advice for a young up and comer in the industry and I chimed in.

Third Point founder, Dan Loeb, liked the story too!

I was 27, newly married, and 10/10 optimistic, if a bit naive about how difficult this transition to Wall Street would end up being physically, mentally, and emotionally. That first day saw a “Flash Crash” or “Black Monday,” when the Dow plummeted almost 1,100 points with the first minutes of trading—one of if not the largest intraday drops ever at the time. China’s economic slowdown among other things sparked global panic. The S&P 500 dropped about 4% on the day to 1,893.

Standing at the Bloomberg terminal with new colleagues, I wasn’t fazed. Remember, I’d seen this movie in 2009. The market rebounded, climbing ~13% by year-end 2015 and hitting record highs by January 2017. But I still had no cash to act—my wife and I were saving for our first home, which we bought in 2017.

Two crashes and two strikes burned in my mind because they happened at two critical life moments. I wouldn’t miss a third pitch.

Back to the Group Chat

“This is my opportunity”

My friends were skeptical at first.

I was half-joking, half-serious—what are group chats for if not the occasional melodramatic rant? But the truth slipped through: I was ready to risk it all. The binary was clear—either the market would rebound, or we’d face bigger problems than money. I plowed our life savings into the market. Countless internal trade compliance approvals later, the Dow ultimately hit 30,000 by November 2020—up 60% from its lowest lows.

That bet wasn’t just about money. The 2020 crash, COVID lockdowns, and my new love for fatherhood—amplified by extra family time thanks to working from home—collided with a burning desire to be an “owner,” controlling my time and life on my terms, inspired partly by my dad’s entrepreneurial path. It sparked a bigger gamble: not just stocks, but life itself.

The market’s 2020–2022 gains gave us a small financial cushion, which we had never had before. It was nice of course, but nowhere near financial independence. I didn’t come from money, and we still don’t have much in the grand scheme. Joking with friends about a world-traveling sabbatical was fun, but unrealistic. So, for six months, I plotted my escape from the Wall Street grind, maybe even the “Matrix” of my old career expectations.

What could I do with my various unrelated skills—construction, emergency medicine, corporate life, and Wall Street—without getting bogged down in “busy work”? Something that traded the bi-weekly paycheck for more family time, with that cushion helping fill in the cash flow gaps? The answer I decided on was small business brokerage. Years earlier, I’d stumbled across a local business for sale in my town and dabbled in the process. Now, I’d join a business brokerage and commercial real estate franchise—an initial stepping across the river to a new career and life.

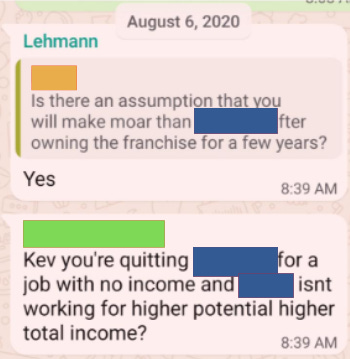

Bantering about the biggest risk by far, so far

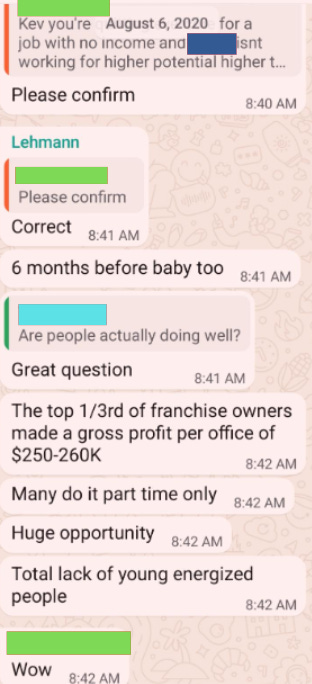

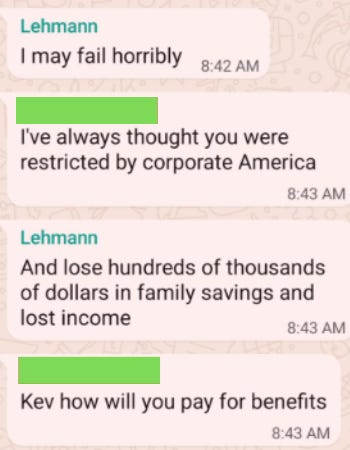

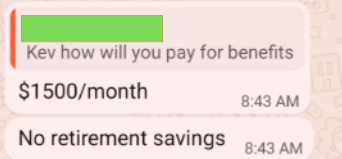

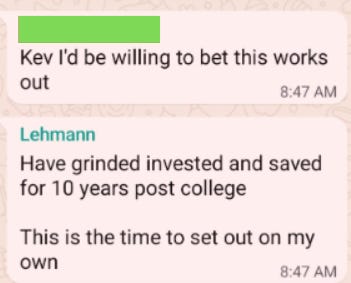

Peak momentum in my career, baby #2 on the way, just bought a bigger more expensive house. I’m days away from resigning, talking it out with my friends in the group chat.

The Real “Binary”

In the group chat, I laid it all out:

“Many people will call me crazy.. and disagree with what I’m pursuing”

“My team will be devasted”

“I may fail horribly… and lose… family savings”

“This is the time to set out on my own”

“Lots of life ahead”

“Why in the world wouldn’t I take this risk?”

My friends shot back:

“I’d be willing to bet this works”

“It’s an excellent risk”

The real “binary outcomes?” You’re either alive or you’re not. So make it count. A lot’s happened since—leaving Wall Street, joining the brokerage, then starting my own consulting and brokerage brand, then moving to Amsterdam and working on what turned out to be a short-term corporate project, then setting up a new EU business and pivoting back to running my own consulting business today. The group chat kept me grounded all the way, stress-testing ideas and cheering me on. Your best friends should roast you to push you further but believe in you fiercely and wholeheartedly.

Put them in a group chat.