Millennials, their Memes, and their Money

Reflections on the eve of a down 1000 DOW morning post-“kind reciprocal” tariffs

If you came of age around the 2008-09 crisis, built your career on the back of cheap capital (ZIRP) and “email jobs,” and maybe turned the COVID-era bull run into a “mid-life semi-retirement” reinvention… this essay is for you. A reflection on the Millennial financial psyche — past, present, and future — as the “globalist” bull era shows signs of cracking, maybe.

Take yourself back to around 2008-09. Millennials — now in their 30s-40s — were staring down the barrel of uncertainty... something they have a venerable PhD in at this point. The financial crisis was delaying, shifting, or outright torching your or your friends’ job prospects — especially in finance and other “managerial class” jobs. I remember one of my best friends had interned with Lehman his junior year, only to get word that maybe, just maybe, Barclays would absorb his role and honor his job offer after they acquired Lehman assets. Personally, I didn’t take my early career prospects seriously. Part of me assumed I’d go into the family construction business, part of me assumed it would be easy to get a decent job in corporate or finance because I had good grades and was always great at “putting myself out there.” I didn’t pursue any finance internships in college. I spent my time working part-time jobs, banging nails during the summer with the family business, enjoying college, and spending a lot of time with my now wife. It’s all worked out, but assuming I could just “walk onto” Wall Street was an early miss.

A lot of people spent the next decade grinding through a recovery that felt like running uphill in flip flops— we were moving but it never felt great. Then right as these folks entered their early 30s — finally got their bearings, maybe bought a house and had a kid — a lab leak or some human-bat shenanigans happened on the other side of the world and the economy literally shut down. Stocks tanked. You may have just gotten your year-end bonus mere weeks before and invested it—watching some of that new money vanish. You’re thinking, “Awesome, can’t catch a break ever.”

But then—plot twist—”money printer go brrrr.”

Congress and the Fed are handing out rescue packages like candy, and suddenly everything you own is mooning. Then you look at a bunch of stuff you don’t own — small cap growth, large cap tech, SPACs, warrants, options, GameStop, Dogecoin — if you were brave, dumb, or perhaps a little numb enough to gamble, your liquid net worth might’ve 2x’d, 5x’d, or 10x’d in just 12-18 months. Even if you played markets conservatively, every day you felt better simply because you were getting richer. Who cares if your job might disappear when your company realizes they don’t see you and don’t really need you and your email-sending skills?

But we soon entered a dreamworld: working from home, dialing into calls in our underwear, taking people “out” for drinks over Zoom, maybe dealing with a few health scares ourselves or among family, and we start asking: “Wait, what the hell am I even doing with my life?” We got a glimpse of what it was like to actually live a life — be around your partner, be around your kids, find out how many cool hobbies or interests you can restart or dust off now that you’re not deleting huge swathes of your time on this earth commuting to an office where you’d do the exact same thing at home sans “team culture” and “serendipitous synergies” with your “work family.”

This sudden wealth boom and the forced pause of COVID flipped a switch. Highly educated folks — finance people, MBAs, consultants, even some lawyers — essentially the “laptop class” — started bailing on W2 jobs. Some became “searchers” and bought small businesses somewhere. Others hung out a solo shingle — consulting, creating content, etc. And the stock market and most assets kept climbing, especially great if you owned a house before COVID. That was another up-and-to-the-right factor for your net worth. And even as the rescue packages faded, all of these gains seemed to stick.

This financial phenomenon funded this weird, “semi-midlife retirement” thing that we all love to talk about on X or LinkedIn — a little global travel, a little family time, maybe a physical SMB in some charming town with great schools a little further out from the immediate city shadow, and an anon X account or virtual consulting/content gig on the side.

Not everyone did this, of course. But all of those who stuck with their careers saw their financial situation on paper skyrocket too… fueling remodeling projects, maybe that extra kid or two, new car, great vacations, maybe a little more swagger and risk-taking at work… just overall strong vibes.

Everybody’s been dancing. Millennials living the dream.

But part of this dream, if not all of it, was propped up by a bull market that refused to end and analysts relentlessly pounding the table on the coming “Roaring 20s” revisited.

But… and there is always a but… behind the curtain, something didn’t feel great. Millennials know this feeling.

The emergence of Trump, MAGAnomics, and COVID revealed this uncomfortable truth. We’d been living through a bull market of modernity — call it the 30-year “globalist” run since NAFTA. Sure, our pampered little feelings were jostled by some volatility — but zoom out and we’d been living on easy street. “Waah I didn’t get the job I wanted out of college. “Waaah I had to live home with my parents instead of getting that apartment in Manhattan… I couldn’t even afford Hoboken!”

Maybe our entire lives — and probably even our Boomer parents’ careers — had been entirely and artificially propped up by cheap labor, free trade, and the financialization of America — it all just propped up the managerial class, the media class, the coastal elites, while the physical world (manufacturing, trucking, making actual things) got hollowed out. Millennials rode the wave, especially the ones who pivoted to digital wealth and were lucky enough to get great email jobs.

But if yesterday’s Rose Garden announcement of “kind reciprocal” tariffs — telegraphed for weeks and months and keeping the market sideways — was the symbolic crescendo of this almost 30-year blip in time… the start of this great rebalancing nobody can actually contextualize because they’ve never lived it — actual, true deglobalization, trade and manufacturing networks totally disappearing at least near/medium-term, and the physical world roaring back stateside even if forced awkwardly and chaotically — it could get ugly for us! Violent even.

Imagine inflation spiking 10-20%, stocks cratering 10-30% over the next 6-18 months, crypto imploding down 50-90%, and all those SMBs, search funds, passive asset income-fueled content creators and solo shingles suddenly underwater. The entire foundation of this recent Millennial confidence boost — liquid wealth, remote work, a stable-ish system — and, for some, the “semi-mid-life retirement” where you could pursue wealth, family, and personal happiness simultaneously — could vanish.

Back to square one, but older, with kids, and a lot more baggage!

Or… maybe it’s fine!

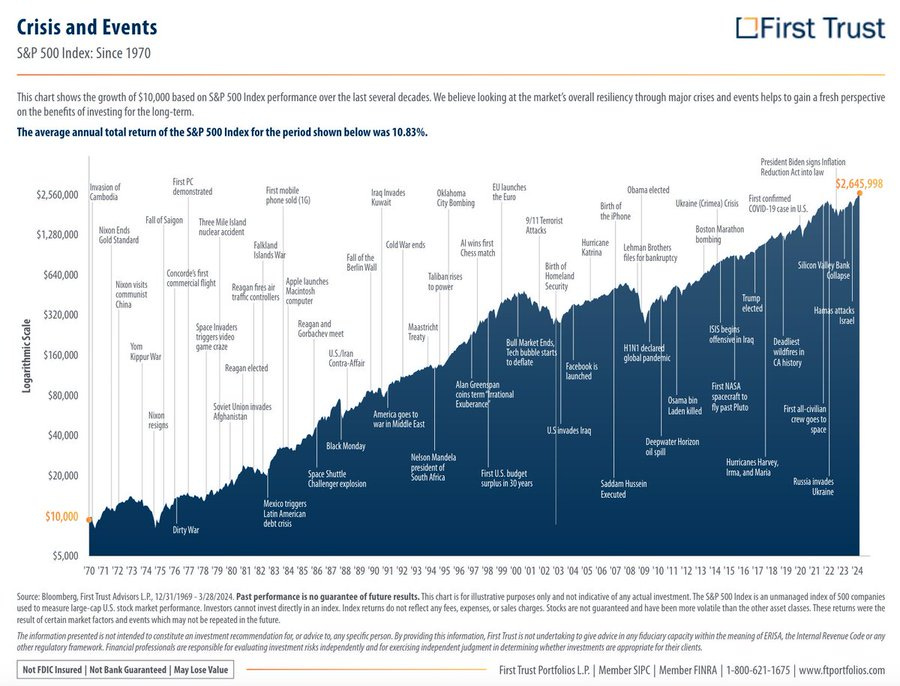

You’ve seen the “Reasons to Sell” type charts like this one…

Markets are maybe not efficient, but they’re weirdly resilient. The S&P 500 has shrugged off dot-com, 2008, COVID — it could shrug this off too, albeit with some sideways years. Tech keeps making ad money as long as we keep doomscrolling, consumers keep buying stuff (until they don’t), and central banks still have their money printers. And we Millennials are adaptable; we’ve remade ourselves before and we’ve gotten pretty damn good at it.

But this nagging bear case is still there. What if this is the end of the globalist bull run!? What if protectionism, resource wars, and a MAGA-fueled right-or-wrong “screw the world for screwing us” mentality break the machine? The psychological toll would be brutal — imagine rebuilding your life in your 40s after betting on a system that you thought was the norm… is deleted. The financial toll even worse.

If it’s just noise, perhaps the bulls keep running. If it’s the signal, then prepare your mind for some pain — or at least an end to the seemingly endless financial pleasure.

So… what to do?

Just keep the reinventing idea in your mind.

What are you really all about?

How’s your health? Relationships with other humans?

Is money just a vehicle for other aspects of your life? Can you find another vehicle if this one breaks down? These are things you should think about all the time anyway. A life stress test, just like the banks do — which are getting hammered pre-market.

Are memes just something you laugh at… or are you the meme?

Personal Note

Of course, this reflection is partly inspired by my own experience. If you’ve followed along these past few years, I quit my Wall Street job, invested aggressively, dabbled in SMB searching, became an SMB broker, hung out a "shingle" by launching a consulting business, moved to the deep burbs, had a second kid, found a ton more time for myself, then moved to Europe to keep the life party going — so I’ll be taking my own advice.

What’s my gut tell me? This party has been great. But if the music stops… I’ll find another party… or host my own!